Two-Pot Retirement System

Lock and secure your retirement savings with the Two-Pot Retirement System. You get peace of mind with access to cash in an emergency while protecting your long-term retirement goals.

Lock and secure your retirement savings with the Two-Pot Retirement System. You get peace of mind with access to cash in an emergency while protecting your long-term retirement goals.

Lock and secure your retirement savings with the Two-Pot Retirement System. You get peace of mind with access to cash in an emergency while protecting your long-term retirement goals.

Starting 1 September 2024, South Africa's retirement savings landscape will see a significant change with the introduction of the Two-Pot Retirement System.

Too many South Africans cashout their retirement savings when changing jobs, leaving them unprepared for retirement and reliant on a government pension grant. To address this, and to encourage a savings culture that will help build financial security, government implemented the Two-Pot Retirement System. This system divides your retirement savings into three pots: Vested Pot, Savings Pot, and Retirement Pot.

It offers you emergency access to part of your savings while ensuring the rest is preserved for your retirement.

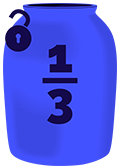

Before 31 Aug ‘24

10% of your retirement savings or R30,000 whichever is the lowest, will be transferred to the Savings Pot. The rest will be protected, and the Two-Pot rules will not apply to it.

There will be no Vested Pot for new retirement savings or funds if you start saving after 1 September 2024.

Before you retire

Your money is locked in until age 55. You cannot withdraw it before then, but we will allow access in some situations.

Being unable to work because of a permanent disability or passing away are two of them.

When you retire

You may take up to one third of the retirement savings in this pot and a lifetime tax-free limit applies.

You must invest the rest to give you an income for life and will be taxed according to legal requirements.

After 1 Sep ‘24

One-third of your retirement contributions will go into your Savings Pot. You can tap into this pot once every tax year, in an emergency.

Before you retire

You have access to the money before age 55 and should only use it for emergencies. The minimum withdrawal amount is R2 000. You will be taxed on the withdrawal amount and will also pay admin fees.

When you retire

You may withdraw this money when you retire. The lifetime tax-free limit applies.

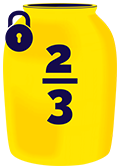

After 1 Sep ‘24

Two-thirds of your contributions will go into your Retirement Pot.

Before you retire

Your money is locked in until age 55. You cannot withdraw it before then, but we allow access in some situations. Being unable to work because of a permanent disability or passing away are two of them.

When you retire

You must invest the total retirement savings in this pot to give you an income for life. You pay tax on the total income you get.

The money in your Savings Pot should be reserved for retirement and only be used in emergencies. By keeping as much money as possible in your retirement savings, you will ensure a more comfortable retirement. Any withdrawals from your Savings Pot will reduce the money available at retirement to secure an income for life.

The Two-Pot System can protect your retirement savings.

The Savings Pot gives you access to cash in an emergency. This can help you avoid dipping into your retirement savings too early, which can reduce the amount of money you have available when you retire.

The Retirement Pot is locked away until you retire. This helps protect your retirement savings from being accessed too early or lost due to financial difficulty.

So South Africans can retire more comfortably.

Government wants South Africans to become a nation of savers, but they understand that members of funds have emergencies as well. The purpose of the new system is to provide flexibility and security for retirement savings. By dividing the retirement savings into pots, the system aims to balance immediate financial needs with the goal of securing a stable income during retirement.

From 1 September 2024, your retirement contributions will be divided into two pots, also known as ‘pots’:

If you were a member of a qualifying retirement savings plan or fund, a once-off transfer of 10% or R30 000 (whichever was the lowest) of your retirement savings was paid into your Savings Pot. The balance of your money remained in the Vested Pot.

If you did not have any retirement savings, you will have to wait until you have saved and accumulated a minimum of R2 000 in your Savings Pot before you can make a withdrawal.

No additional contributions will be paid into your Vested Pot and the money in it will grow with investment returns.

However, if you change jobs, resign, are dismissed or retrenched you will be allowed to:

No, you cannot access the money in your Retirement Pot. This money must remain invested until you retire. You must use it to buy a pension income plan when you retire.

You do not need to make a withdrawal if you do not have an emergency. The money in the Savings Pot will accumulate and carry over to the next year till your retirement date.

Yes, you will. The money in your Savings Pot will continue to grow and earn interest the longer it remains untouched. This means your overall retirement savings will increase over time, helping you build a more substantial nest egg.

It’s important to remember that the Savings Pot is not meant to be used like a regular savings account. Avoid using it to fund holidays and entertainment expenses or to buy furniture. It is meant to provide for financial emergencies and should only be considered when no other options are available. These emergencies will vary for each person but may include situations like paying medical bills or covering rent to prevent being evicted.

Tax rates: Withdrawals from the Savings Pot are taxed at your marginal tax rate. This means that the tax you pay depends on your income bracket. For example:

Arrear tax deduction: Before any benefit is paid out from the Savings Pot, arrear tax (if applicable) will be deducted by SARS. Metropolitan will apply for a tax directive, and if you have outstanding tax debt, it will be deducted from the withdrawal amount before you receive the balance.

Withdrawal fee: Keep in mind that a withdrawal fee of R300 will also be deducted. The tax is calculated on the net withdrawal amount after deduction of the fee.

E.g. if you want to deduct R5 000 and the SARS directive indicates taxes of R1 000, we will pay your R5000 – R300 – R1000 = R3700.

We strongly recommend that you get financial advice and understand the implications before making any withdrawals.

Tax directives will be required for withdrawals from the Savings Pot. SARS will require a member’s tax reference number and annual income for these tax directives.

Tax directives will still be required for all other payouts, including transfers to another fund.

Tax directives will not be required for:

You may request that your personal information held by Metropolitan be removed.

Please note that you will be contacted with regards to this request; as there may be other applicable laws that may prevent your data from being deleted.